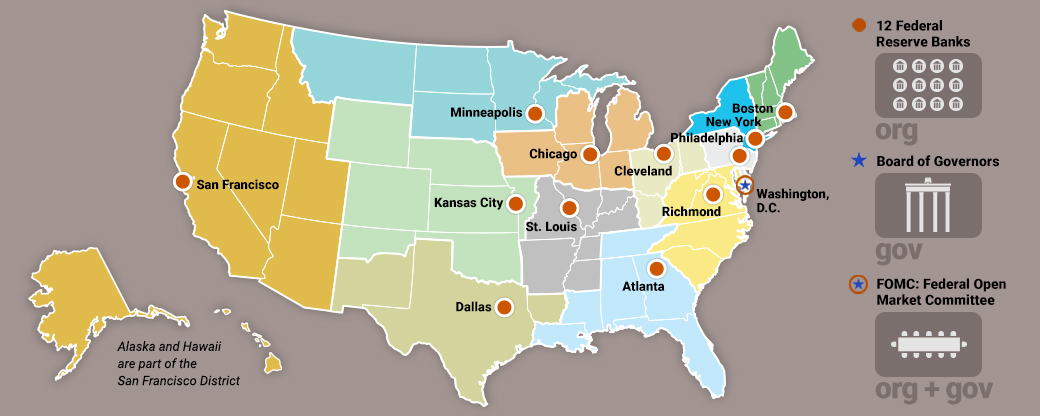

It wad created to establish economic stability in the US and established a central bank to supervise the monetary policy. Map of the 12 Federal Reserve Districts.

How The Federal Reserve System Was Formed

The Structure of the Federal Reserve System is unique among all the assets within central banks with private aspects.

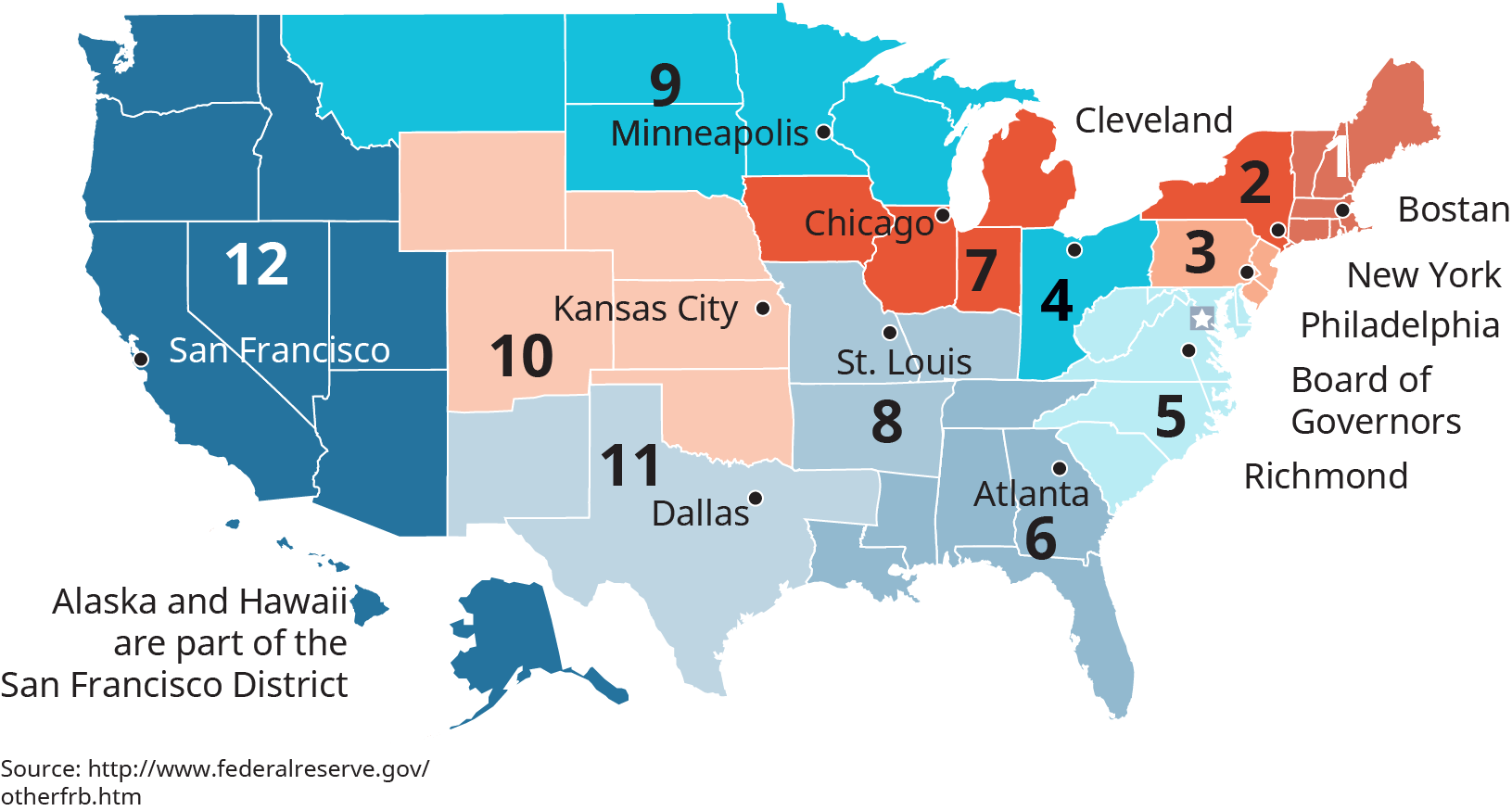

. Each district is made up of more than one state and each district banks board of nine directors is elected by member banks within the district. Notice that the size of the districts in the Northeast tend to be very small while those in the West are very large. The Federal Reserve Act of 1913 created the US federal Reserve system.

1 - Boston District No. The Federal Reserve does not require public funding instead it remits its profits to no one. Three Districts San Francisco Atlanta and Dallas have recorded sizeable gains in the share of population since 1913.

Federal Advisory Council FAC Research division of the Fed. In the Twelfth District the Seattle Branch serves Alaska and the San Francisco Bank serves Hawaii. The 12 regional Federal Reserve banksincluding the St.

Government Reserve Banks handle the Treasurys payments sell government securities and assist with the Treasurys cash management. The act also built twelve federal reserve districts and one federal reserve banks for each of the district. It is described as independent within the government rather than independent of government.

Branches at Baltimore and Charlotte District 6 - Atlanta 13. The Federal Reserve Bank is the central bank of the United States and arguably the most powerful financial institution in the world. The Federal Reserve System is made up of 12 regional banks and 24 branches.

DESCRIPTION OF FEDERAL RESERVE DISTRICTS 1 Federal Reserve District Land area square miles Population 1960 census District No. The Twelfth District has experienced the largest change. The Federal Capital.

4 - Cleveland District No. The original act set fixed reserve requirements for the US. 3 - Philadelphia.

A Reserve Bank is often called a bankers bank storing currency and coin and processing checks and electronic payments. Federal Open Market Committee FOMC Makes key decisions about interest rates and decide. Branches at Birmingham Jacksonville Miami Nashville and New Orleans.

7 - Chicago District No. Describe the Federal Reserve system How many districts are in the Fed system from AA 1. The Federal Reserve is responsible for monetary policy.

Louis Fedprovide our central banking system with a decentralized operating structure. The regional banks were set up intentionally to disperse throughout the country power that might otherwise be. This size discrepancy relates to the population distribution in 1913 when the population.

2 - New York District No. For example since 1913 the share of population accounted for by each Federal Reserve District has changed. 6 - Atlanta District No.

All but one of the other nine Districts have lost share. The Board of Governors the Federal Open Market Committee FOMC and the 12 Federal Reserve Banks. The Federal Reserve Act of 1913 called for a central banking system with a central governing Board and a decentralized operating structure of multiple Reserve Banks.

There are three key entities in the Federal Reserve System. All the federal reserve banks implement the. The Federal Reserve official identifies its Districts by number and city in which its head office is located.

The Federal Reserve is carefully designed to represent many viewpoints. The modern Federal Reserve resulted from the Federal Reserve Act of 1935 which. The System serves commonwealths and territories as follows.

5 - Richmond District No. Branches at Cincinnati and Pittsburgh District 5 - Richmond 11. Federal Reserve Bank.

District 7 - Chicago 16 Branch at Detroit. A federal district is a type of administrative division of a federation usually under the direct control of a federal government and organized sometimes with a single municipal body. This hybrid structure is still in place today.

The Feds Regional Structure. Clicking on the box will take you to a System map. The New York Bank serves the Commonwealth of Puerto Rico and the US.

Reserve Banks also supervise commercial banks in their regions. District 3 - Philadelphia 8 District 4 - Cleveland 9. Federal districts often include capital districts and they exist in various federations worldwide.

The commercial banks in each district elect a Board of Directors for each regional Federal Reserve Bank and that board chooses a president for each regional Federal Reserve district. District 1 - Boston 6. It allowed each district bank to determine its discount rate the rate it charged on loans to member banks.

Fractional reserve banking system. Providing banking services to depository institutions and to the. The Federal Reserve Districts which there are twelve of each have one Federal Reserve Bank that monitors and reports on economic and banking conditions in its district.

1914 map of the Federal Reserve System and District borders from the Decision of the Reserve Bank Organization Committee. Thus the Federal Reserve System includes. 12 banking districts created by the Federal Reserve Act.

This map highlights the 12 Reserve Bank Districts and identifies each District with its designated number and letter plus its headquarters and branches. District 2 - New York 7 Branch at Buffalo. It derives its authority and purpose from the Federal Reserve Act.

The Federal Reserve districts and the cities where their regional headquarters are located are shown in the figure 72. These components share responsibility for supervising and regulating certain financial institutions and activities. The Federal Reserve Bank was founded by.

Each bank and its corresponding branches are listed below. As the bank for the US.

What Is The Fed Structure Education

Understanding The Federal Reserve Banks

:max_bytes(150000):strip_icc()/dotdash_Final_WhatDo_the_Federal_Reserve_Banks_Do_May_2020-01-08af2fa345a440ff9df4c83495ad4328.jpg)

0 Comments